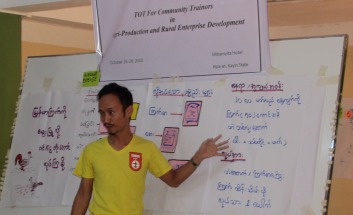

Saw Hein Htet Win, PP Technical Consultant on Enterprise Development facilitating during the TOT for community-based trainors

The technologies being employed at present are traditional, hence agricultural productivity in the rural areas are not maximized. This is one of the concerns being addressed by the Project. Aside from cooperative formation, the other half of the financial inclusion project is the enhancement of agricultural production and rural enterprises to contribute to the increase of income of people in the villages. The concept is for the cooperative to provide loans to economic activities that are profitable and can be done without subsidy from the government or development agencies.

Based on this premise, the project implemented activities to determine the enterprises that can be enhanced and financed by the cooperative. The first initiative was to do a farm systems analysis to look at current farm production activities. From the analysis, a list of agricultural commodities was made. Second, a value chain analysis was done to include current crops and livestock to determine the most profitable commodities. The third initiative was to set up demonstration farms for crops and livestock and models for non-agri enterprises.

The savings groups in each village agreed on one commodity or enterprises that will be tested in their area. A total of 33 demonstration and modeling activities were implemented since the second half of 2015 up to the present. Demonstration farms were made for crops and livestock: mushroom, corn, beans, goat, poultry, native chicken and hogs. Modeling of rural enterprises particularly garments retailing, concrete products, ricemill operation, rice trading, molasses trading, lumber retailing and grocery store were also done.

Despite the varied results of the modeling and demonstration farms, there are those who successfully showed how to make the commodities and the enterprises profitable. These farmers and entrepreneurs were selected and invited to become community-based trainors. The trainors will provide training to other members of the cooperative who are interested in venturing into crops or enterprises they have demonstrated. The cooperative will require borrowers to undergo training with the community-based trainors who will be paid for the training services they provide.

The first batch of trainors completed a three-day training of trainors (TOT) conducted last October 26-28 at the Mibmyita Hotel in Hpa-an. The commodities covered included mushroom, chicken, beans, goat, hogs and corn; and an enterprise, concrete products.

To equip the trainors and make them effective, topics discussed included concepts of adult education and use of appropriate tools and instruments in training. Participants were given time to prepare a basic training tool they presented during the last day of the training. Constructive critiquing from other participants provided guide on how to make their tool relevant and effective.

It is envisioned that the community-based trainors will be the backbone in improving farm and rural enterprise technologies that will eventually contribute to the improved quality of products in the villages and ultimately increase income of the farmers and entrepreneurs. The training is also expected to lower the credit risk of the cooperative brought about by failure in production.

The knowledge and skills of the trainors will also be enhanced through exposures in other areas and formal training from extension schools.